A collision claim settlement is a process where insurance companies compensate policyholders for vehicular accident losses, aiming to restore them financially to their pre-accident state. It begins with filing a claim, submitting relevant documents, and adjusting repair/replacement costs. After ensuring safety, document the incident and contact your insurer to file a claim, providing accounts and repair estimates. The insurer assesses the claim and negotiates repairs for a fair settlement. Understanding rights and options is crucial; gather information, document losses, exchange insurance details, and seek medical attention if needed. Choose between filing a claim with your insurer, negotiating directly, or pursuing legal action based on comfort level and case complexity.

“Unraveling the intricacies of a collision claim settlement is crucial for anyone involved in a vehicular accident. This comprehensive guide aims to demystify the process, empowering drivers with knowledge about their rights and options. From understanding the initial steps after an accident to navigating the settlement phase, we’ll break down the key aspects. Whether you’re a seasoned driver or a novice, grasping the fundamentals of collision claim settlement can ensure fair compensation for your troubles. Get ready to explore your choices and advocate for yourself in this often-confusing situation.”

- What is a Collision Claim Settlement?

- The Process of Claiming and Settling

- Understanding Your Rights and Options

What is a Collision Claim Settlement?

A collision claim settlement is the process by which insurance companies compensate policyholders for losses incurred in a vehicular accident. This typically involves repairs or replacements for damaged vehicles, medical expenses for injuries sustained, and compensation for any other associated costs. The goal of a collision claim settlement is to restore policyholders to their pre-accident financial state, ensuring they receive fair reimbursement for the damage done.

This process begins with filing a claim, usually after an accident involving property damage or personal injury. The insured party provides relevant details and documents, such as police reports, medical bills, and estimates from auto body services or vehicle restoration centers. Following an evaluation of these claims, insurance adjusters determine the cost of repairs or replacements and negotiate a settlement amount with the policyholder, aiming to reach an agreement that is mutually beneficial and just in light of the circumstances.

The Process of Claiming and Settling

When a collision occurs, the first step in claiming and settling is to ensure everyone’s safety. Once immediate risks are mitigated, document the incident by taking photos of damage to vehicles involved, exchanging insurance information with the other driver, and recording details like dates, times, and witness statements. This foundational work is crucial for the subsequent collision claim settlement process.

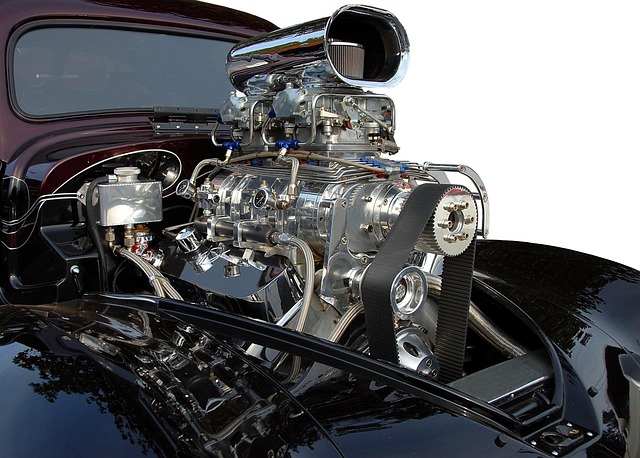

The next phase involves contacting your insurance provider to report the accident. They will guide you through specific steps tailored to your policy and location. Typically, this includes filing a claim, providing detailed accounts of the incident, and possibly submitting repair estimates for vehicle dent repair, auto painting, or tire services, depending on the extent of the damage. Once all necessary information is submitted, the insurance company assesses the claim and negotiates with repair shops to determine the most cost-effective solutions, ultimately working towards a fair collision claim settlement.

Understanding Your Rights and Options

When involved in a collision, it’s crucial to understand your rights and options regarding the claim settlement process. Every driver has the right to seek compensation for any damages incurred as a result of an auto collision, whether it involves car bodywork or more complex repairs. The first step is to gather all necessary information from the other party and document any injuries or losses. This includes taking photos of the vehicles involved, exchanging insurance details, and seeking medical attention if needed.

Knowing your rights means understanding the various options available for collision claim settlement. You can choose to file a claim with your insurance company, negotiate directly with the at-fault driver’s insurer, or even pursue legal action. Each method has its advantages and potential drawbacks, so it’s important to weigh these carefully. The goal is to ensure you receive fair compensation for any auto collision repair expenses while also considering your personal comfort level and the complexity of the case.

Knowing the basics of collision claim settlement empowers you to navigate this process with confidence. By understanding what constitutes a collision claim, familiarizing yourself with the step-by-step procedures, and recognizing your rights and options, you can make informed decisions when settling a collision claim. This knowledge ensures you receive fair compensation for any damages incurred during an accident. Remember, while these guidelines offer a solid foundation, each situation is unique; seeking professional advice tailored to your specific case is invaluable.